When I graduated college with a degree in Theatre Production, I spent the better part of the next four years lining up gig after gig. Booking myself solid all over the country from one month contracts to three month extended stays.

It was the month of December, however, that was sacred. Only once did I book myself on a show run that extended past Christmas and into the New Year. That month was regularly devoted to returning home to my family and taking some much needed time off.

So, I quickly became a bit of an expert in planning time off, what it takes, and how to do it. I guess you could say this post has been a work in progress for over 10 years.

That Gig Life

But notice I mentioned lining up gig to gig, contract to contract. If I didn’t work, I didn’t make money. My time off was unpaid when I lived the theatre life….and my time working wasn’t exactly raking in the big bucks to jet off to Europe for a month during that free time.

I knew things needed to be different when I set out on my own years later. I knew that, for me, being a business owner meant making my own schedule, taking time off when I needed/ wanted it, and providing the life I could only dream of for my family.

Pro Tip: Your dream is your dream. Owning and running your own business can look however you want it to look. Want to work long days with clients you adore? Do it! Want to travel by train through France never checking your email? It’s yours! Write your own dreams down and make them a reality.

And whether you’re planning a trip or planning to hire your very first team member, you need a plan. That plan, my friend, is all about what makes sense cents.

Money Matters

Sharpen your #2 pencils and get that calculator out. It’s time to figure out what you’ve got and what you’re gonna do with it.

First, you have to know what you need. If you don’t already have an accounting software you are familiar with, there are several out there. Quickbooks and Xero are two of the most popular and reliable (they're trusted by professional bookkeepers worldwide).

I use Quickbooks every single day. I invoice, time track (if I need it), and reconcile, all in Quickbooks. My Quickbooks account even imports my business credit card and bank account transactions (you have those, right? separate accounts for your business? muy importante). I go in daily, clean up anything that needs to be cleaned up, and check in on my money status. Getting this baby setup was the best thing I ever did for my productivity and stress level.

The. best. thing. ever.

So go get setup with something that does the heavy lifting for you.

Next...

Know thine living expenses

I used to live off of a paycheck. Like, cash it at the grocery store, spend that cash until it was gone, wait for the next check.

Sound familiar?

It was so stressful and I’m pretty sure I had no idea how much it actually cost me to live and what the word “budget” even was. I bet if I could go back and have a budget laid out in those days, I could have saved at least $20 of each check instead of blowing it at Target (because, let’s be honest, it’s the best way to blow $20).

Once you know what you need to make each month to live off of, you can start to figure out how much you need to make to save up for that vacay or have in the bank to pay your assistant.

Remember Algebra? Here ya go:

For a vacation:

If x equals your monthly living expenses and y equals the number of months in total you want to take off for the year, then x multiplied by y is z – the total in extra funds you’ll need to take that time off.

For hiring:

If x equals your monthly revenue and y equals your monthly expenses then x minus y equals money in the bank for your business – we’ll call that z. (aka – revenue you can invest back into things with a new team member).

Next level math on this one: If b equals the hours you want hire someone for and c equals their rate, then b multiplied by c equals the total monthly cost of your new team member – we’ll call it d. Compare z to d and you’ll know if you can afford to hire or if you need to scale back the hours to get started.

When I planned my maternity leave back in 2014, I not only was planning time away, I also had a team keeping a few crucial things running for me.

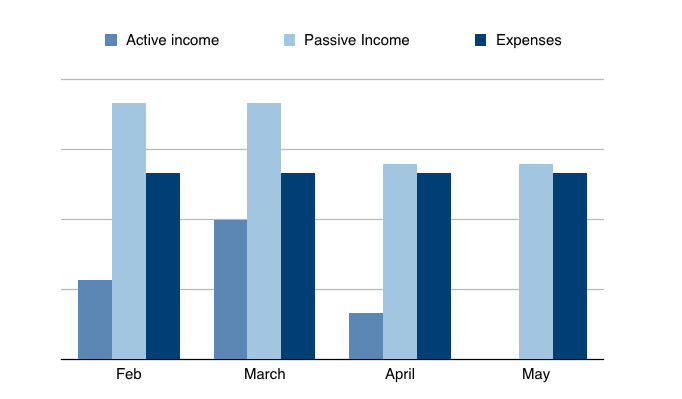

This is the exact plan I had going into my maternity leave. Let me point out a few key things:

- In March my Active Income bucket increased dramatically. I hustled a whole bunch to get things in gear for my pending leave.

- In April my Active Income bucket dropped way down. I planned to be out the last week of April and was also doing some major team training (as outlined in Part 1) and I simply wasn’t bringing in as much Active Income.

- My Expenses never changed. In fact, I’d say they increased the day my daughter was born but that’s not reflected here, obvi.

- My Passive Income dropped down while I was on leave. I paid my team more to spend more hours in my business, so my Passive Income dropped to meet those payouts.

- Maternity leave was mostly baby snuggling and bonding fest. It required little extra income as we weren’t exactly jetting off to Paris. My Passive Income covered my expenses and little more. Your plan might be a bit different.

By planning ahead, I was able to meet my expenses while I was away and still retain a little income on top of that.

Think about it like this: by putting a plan in place and gearing up a team to help you run your business while you are away, you’re setting yourself up to have retained income while you’re gone at any point in your business.

My new bookkeeper calls it a "War Chest" fund.

Is all this money talk starting to make it feel real? A little scary?

Perfect!

Share in the comments below two things:

1) What scares you most

2) Why you're going to do it anyways

You deserve to run a business that serves you, not the other way around!

We're rooting for you!

Comments